| ☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange ActRules 14a-6(i)(1) and0-11 |

Message To Our Stockholders

Dear Stockholder:

| |||||||||

You are cordially invited to attend the

The Annual Meeting webcast may be attended by company stockholders and others by visiting the following website at the designated time: www.virtualshareholdermeeting.com/

To be admitted to the Annual Meeting webcast at the website provided above, holders of Paramount Class A Common Stock and Paramount Class B Common Stock should enter the 16-digit control number found on their Notice of Internet Availability of Proxy Materials, proxy card or voting instruction card, as applicable. Any others may attend the meeting as a guest by following the instructions provided on the Annual Meeting website.

As always, we encourage holders of Class A Common Stock to submit their proxy and vote their shares prior to the Annual Meeting. Class A stockholders may vote in advance of the meeting by telephone or through the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials or in the

Holders of Class A Common Stock and Class B Common Stock may submit questions in advance of the meeting, from 9:00 a.m., Eastern Daylight Time, on

National Amusements, Inc., which as of

If you have elected to receive printed copies of our proxy statements, annual reports and other materials relating to the Annual Meeting and want to elect to receive these documents electronically next year instead of by mail, please go to http://enroll.icsdelivery.com/para and follow the instructions to enroll. We highly recommend that you consider electronic delivery of these documents as it helps to lower our costs and reduce the amount of paper mailed to your home.

We appreciate your interest in and support of Paramount and look forward to your participation at the Annual Meeting.

Sincerely,

Robert M. Bakish President and Chief Executive Officer |

Key Strategic and

•

• Paramount Pictures released

• CBS finished the

• | ||||||||

Notice of 20232024 Annual Meeting of Stockholders

To Paramount Global Stockholders:

The

The principal business of the Annual Meeting will be the consideration of the following matters:

1 The election of

2 The ratification of the appointment of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for fiscal year

3

4

5 A stockholder proposal, if properly presented at the meeting, requesting that our Board of Directors take steps to adopt a policy

6 A stockholder proposal, if properly presented at the meeting, requesting

7 Such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

For a period of at least 10 days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be open to the examination of any stockholder during ordinary business hours by calling Investor Relations at 1-877-227-0787. In addition, a complete list of stockholders entitled to vote at the Annual Meeting will be open to the examination of any stockholder during the meeting by following the instructions on the Annual Meeting website once they enter the meeting.

By order of the Board of Directors,

Christa A. D’Alimonte Executive Vice President, General Counsel and Secretary

April 22, 2024 |

Meeting Information

Date and time:

at 9:00 a.m. EDT

Website: www.virtualshareholdermeeting.com/

Record date:

|

| PARAMOUNT GLOBAL |

|

Table of Contents

| PARAMOUNT GLOBAL |

|

Paramount Global

20232024 Proxy Statement

Proxy Statement Highlights

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy statement before voting.

20232024 ANNUAL MEETING OF STOCKHOLDERS

The 20232024 Annual Meeting of Stockholders (the “Annual Meeting”) of Paramount Global (“we,” “us,” “our,” “Paramount” or the “Company”) will be held by live webcast at the date, time and website noted below.

Date and time:

9:00 a.m. EDT

|

Website: www.virtualshareholdermeeting.com/ |

Record date:

|

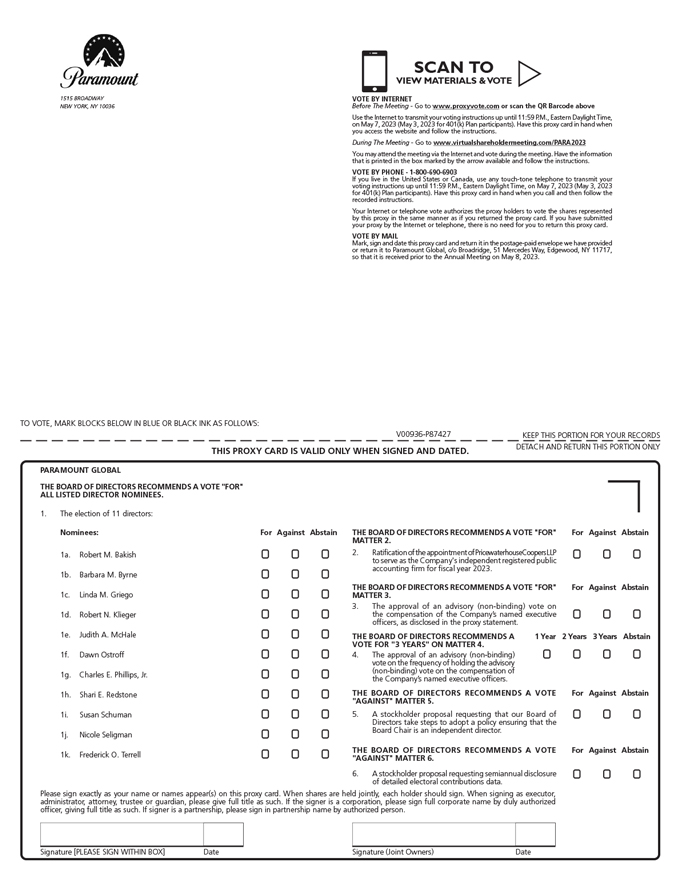

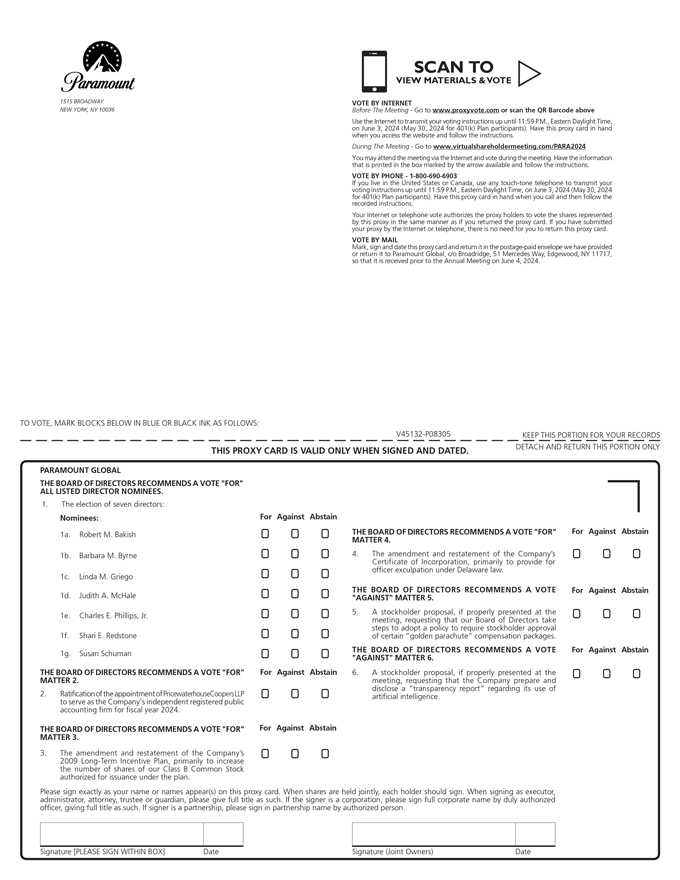

HOW TO VOTE

If you are a stockholder of record, you may vote during the Annual Meeting by following the instructions on the Annual Meeting website once you enter the meeting, or by proxy using any of the following methods:

| By Internet:

|

| By mail:

If you receive a paper copy of the proxy materials, you may also vote by completing, signing, dating and returning the proxy card by mail. | ||||

| By telephone:

|

Votes submitted by Internet or phone must be received by 11:59 p.m., Eastern Daylight Time, on May 7, 2023.June 3, 2024. Votes submitted by mail must be received prior to the Annual Meeting. Please see “Voting and Solicitation of Proxies” for detailed voting instructions.

VOTING MATTERS AND BOARD RECOMMENDATIONS

| Item | Description | Board Vote Recommendation | Page Reference (for more detail) | |||||||||

| Item | Description | Board Vote Recommendation | Page Reference (for more detail) | |||||||||

| 1 | ||||||||||||

| 1 | The election of 11 directors | FOR each of the director nominees | 25 | The election of the seven nominated directors | FOR each of the director nominees | 26 | ||||||

| 2 | The ratification of the appointment of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for fiscal year 2023 | FOR | 36 | |||||||||

| 2 | The ratification of the appointment of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for fiscal year 2024 | FOR | 33 | |||||||||

| 3 | An advisory (non-binding) vote on the compensation of the Company’s named executive officers, as disclosed in this proxy statement | FOR | 77 | |||||||||

| 3 | The amendment and restatement of the Company’s 2009 Long-Term Incentive Plan (the “LTIP”), primarily to increase the number of shares of our Class B Common Stock authorized for issuance under the plan | FOR | 76 | |||||||||

|

|

PROXY STATEMENT HIGHLIGHTS

| Item | Description | Board Vote Recommendation | Page Reference (for more detail) | |||||||||

| Item | Description | Board Vote Recommendation | Page Reference (for more detail) | |||||||||

| 4 | ||||||||||||

| 4 | An advisory (non-binding) vote on the frequency of holding the advisory (non-binding) vote on the compensation of the Company’s named executive officers (every one year, two years or three years) | THREE YEARS | 78 | The amendment and restatement of the Company’s Certificate of Incorporation (the “Charter”), primarily to provide for officer exculpation under Delaware law | FOR | 83 | ||||||

| 5 | A stockholder proposal requesting that our Board of Directors take steps to adopt a policy ensuring that the Board Chair is an independent director | AGAINST | 80 | |||||||||

| 5 | A stockholder proposal, if properly presented at the meeting, requesting that our Board of Directors take steps to adopt a policy to require stockholder approval of certain “golden parachute” compensation packages | AGAINST | 84 | |||||||||

| 6 | A stockholder proposal requesting semiannual disclosure of detailed electoral contributions data | AGAINST | 82 | |||||||||

| 6 | A stockholder proposal, if properly presented at the meeting, requesting that the Company prepare and disclose a “transparency report” regarding its use of artificial intelligence | AGAINST | 87 | |||||||||

HOW TO SUBMIT QUESTIONS

Holders of Class A Common Stock and Class B Common Stock may submit questions in advance of the meeting, from 9:00 a.m., Eastern Daylight Time, on April 24, 2023May 22, 2024 until 5:00 p.m., Eastern Daylight Time, on May 3, 2023,29, 2024, by visiting www.proxyvote.com, entering their 16-digit control number and following the instructions. Holders of Class A Common Stock and Class B Common Stock may also submit questions during the meeting and will find instructions for doing so on the Annual Meeting website once they enter the meeting.

BOARD AND GOVERNANCE HIGHLIGHTS

Board of Directors: Nominees for Election

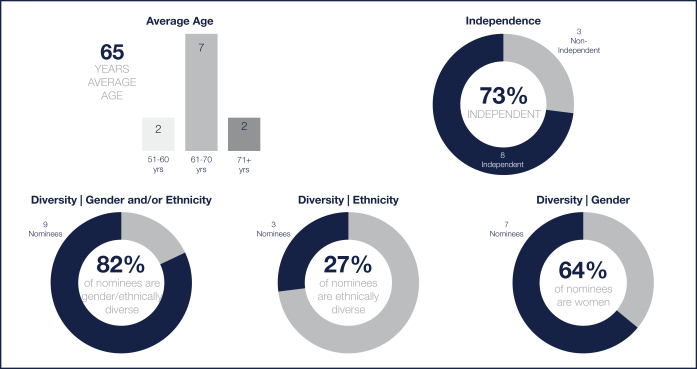

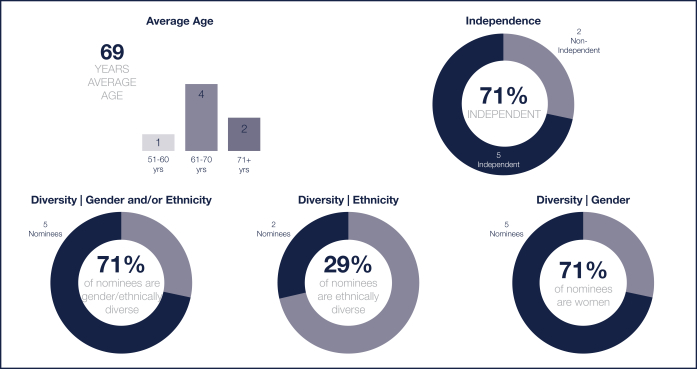

Our 11seven director nominees (ten of whom are current members of our Board of Directors (the “Board of Directors” or “Board”)), and, as a group, have extensive and diverse leadership and subject matter experience and knowledge that is important to us. Our nominees include eightfive independent directors. Effective as of the Annual Meeting, the size of the Board will be reduced to seven directors.

Name | Age | Director Since | Career Highlights | Independent Director | Standing Committee Memberships | |||||||||||||||

Name | Age | Director Since | Career Highlights | Independent Director | Standing Committee | |||||||||||||||

Shari E. Redstone† | ||||||||||||||||||||

Shari E. Redstone† | 68 | 1994 | Chairperson, Chief Executive Officer and President of National Amusements, Inc. and Co-Founder and Managing Partner of Advancit Capital | |||||||||||||||||

Robert M. Bakish | 59 | 2019 | President and Chief Executive Officer, Paramount Global | |||||||||||||||||

Barbara M. Byrne | 68 | 2018 | Former Vice Chairman, Investment Banking at Barclays PLC | ✓ | AC* | 69 | 2018 | Former Vice Chairman, Investment Banking at Barclays PLC | ✓ | AC* | ||||||||||

Linda M. Griego | 75 | 2007 | President and Chief Executive Officer of Griego Enterprises, Inc. | ✓ | CC | 76 | 2007 | President and Chief Executive Officer of Griego Enterprises, Inc. | ✓ | CC | ||||||||||

Robert N. Klieger | 51 | 2017 | Partner at Hueston Hennigan LLP | |||||||||||||||||

Judith A. McHale | 76 | 2019 | President and Chief Executive Officer of Cane Investments, LLC | ✓ | AC; CC* | 77 | 2019 | President and Chief Executive Officer of Cane Investments, LLC | ✓ | AC; CC* | ||||||||||

Dawn Ostroff | 62 | N/A | Former Chief Content and Advertising Business Officer of Spotify | ✓ | N/A | |||||||||||||||

Charles E. Phillips, Jr. | 63 | 2019 | Co-Founder and Managing Partner of Recognize | ✓ | NG | 64 | 2019 | Co-Founder and Managing Partner of Recognize | ✓ | NG | ||||||||||

Susan Schuman | 63 | 2018 | Executive Chair and Co-Founder of SYPartners LLC and Vice Chair of kyu Collective | ✓ | NG | 65 | 2018 | Executive Chair and Co-Founder of SYPartners LLC and Vice Chair of kyu Collective

| ✓ | NG* | ||||||||||

Nicole Seligman | 66 | 2019 | Former President of Sony Entertainment, Inc. | ✓ | NG* | |||||||||||||||

Frederick O. Terrell | 68 | 2018 | Senior Advisor, Centerbridge Partners, L.P. | ✓ | AC | |||||||||||||||

AC = Audit Committee

CC = Compensation Committee

NG = Nominating and Governance Committee

* = Committee Chair

† = Non-Executive Chair of the Board

| 2 PARAMOUNT GLOBAL |

|

PROXY STATEMENT HIGHLIGHTS

Director Nominee Composition

EXECUTIVE COMPENSATION HIGHLIGHTS

Compensation Philosophy and Objectives

We designed our executive compensation programs to motivate and reward business success and to increase shareholder value, based on the following core objectives:

Pay for Performance Ensure plans provide reward levels that reflect variances between actual and desired performance results.

|

Flexible Enable management and the Board to make decisions based on the needs of the business and to recognize different levels of individual contribution.

| ||||

Market Competitive Consider compensation programs of our peers in order to attract and retain the talent needed to drive sustainable competitive advantage and deliver value to shareholders.

|

Focused on Shareholder Value Align executives’ interests with shareholder interests, with particular emphasis on creating incentives that reward executives for consistently increasing the value of Paramount. | ||||

|

|

PROXY STATEMENT HIGHLIGHTS

Pay for Performance

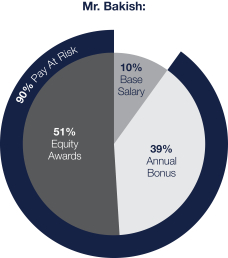

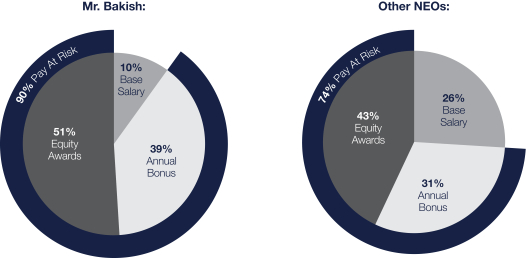

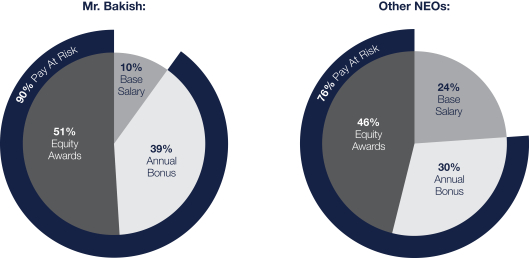

We believe that those executives with significant responsibility and a greater ability to influence our results should have a significant portion of their total compensation tied directly to business results, and we have continued to shift our executive compensation packages to further emphasize performance-based compensation that is aligned with our business and operational strategy. Accordingly, a high percentage of our named executive officers’officers (“NEOs”) and other senior executives’ total target compensation is “at risk” – meaning that we do not intend for them to receive targeted pay amounts if performance does not meet expectations. For 2022, the Compensation Committee increased the percentage of Mr. Bakish’s and our other NEOs’ long-term equity incentive awards that was delivered in performance share units to 50% and 35%, respectively.

Consistent with this philosophy, our performance-based compensation programs provide for the opportunity to reward NEOs and other senior executives for contributing to annual financial and operational performance (through annual bonusincentive programs) and stock price appreciation (through long-term equity incentives). The only fixed component of pay is annual base salary. Annual cash incentive awards and long-term equity incentive awards are subject to companyCompany performance and/or stock price performance.

As illustrated below, approximately 90% of Mr. Bakish’s total target compensation as of December 31, 20222023 was at risk and thus strongly linked to our results.

| 4 PARAMOUNT GLOBAL |

|

Voting and Solicitation of Proxies

SOLICITATION OF PROXIES

A proxy is being solicited by our Board of Directors for use at the Annual Meeting. The close of business on March 13, 2023April 12, 2024 is the record date for determining the record holders of our Class A Common Stock, par value $0.001 per share, entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. Holders of our non-voting Class B Common Stock, par value $0.001 per share, are not entitled to vote at the Annual Meeting or any adjournment or postponement thereof.

As of March 13, 2023,April 12, 2024, we had outstanding 40,704,34140,702,775 shares of our Class A Common Stock, with each of such shares entitled to one vote, and 610,765,722625,768,451 shares of our non-voting Class B Common Stock (together with our Class A Common Stock, our “Common Stock”).

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with SECSecurities and Exchange Commission (“SEC”) rules, instead of mailing to stockholders a printed copy of our proxy statement, annual report and accompanying letter to stockholders (the “proxy materials”), we intend to mail to stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), which advises that the proxy materials are available on the Internet. We intend to commence our distribution of the Notice of Internet Availability on or about March 22, 2023.April 23, 2024. Stockholders receiving a Notice of Internet Availability by mail will not receive a printed copy of proxy materials, unless they so request. Instead, the Notice of Internet Availability will instruct stockholders as to how they may access and review the proxy materials on the Internet.

Stockholders who receive a Notice of Internet Availability by mail whoand would like to receive a printed copy of our proxy materials, including a proxy card or voting instruction card, should follow the instructions for requesting these materials included in the Notice of Internet Availability. Stockholders who currently receive printed copies of proxy materials whoand would like to receive future copies of these documents electronically instead of by mail should follow the instructions for requesting electronic delivery set forth in the “Other Matters” section of this proxy statement.

SUBMISSION OF PROXIES

Each of Robert M. Bakish, our President and Chief Executive Officer, and Christa A. D’Alimonte, our Executive Vice President, General Counsel and Secretary (the “proxy holders”), individually and with the power to appoint his or her substitute, has been designated by our Board of Directors to vote the shares represented by proxy at the Annual Meeting. They will vote the shares represented by each valid and timely received proxy in accordance with the stockholder’s instructions, or if no instructions are specified, in accordance with the recommendations of the Board as described in this proxy statement. If any other matter properly comes before the Annual Meeting, the proxy holders will vote on that matter in their discretion.

Holders of record of our Class A Common Stock as of March 13, 2023April 12, 2024 may submit a proxy in the following ways:

| • | By Internet: Holders of record may access www.proxyvote.com and follow the online instructions. The Internet proxy must be received no later than 11:59 p.m., Eastern Daylight Time, on |

| • | By Telephone: Holders of record living in the United States or Canada may use any touch-tone telephone to call 1-800-690-6903 and follow the recorded instructions. The telephone proxy must be received no later than 11:59 p.m., Eastern Daylight Time, on |

By Mail: Holders of record who received a printed copy of the proxy materials may complete, sign and date the proxy card and return it in the envelope provided, so that it is received prior to the Annual Meeting.

“Beneficial holders” (defined below) will receive voting materials, including instructions on how to vote, directly from their broker or other nominee as the holder of record.

Shares Held in our 401(k) Plan. Voting instructions relating to shares of our Class A Common Stock held in our 401(k) plan must be received no later than 11:59 p.m., Eastern Daylight Time, on May 3, 202330, 2024, so that the trusteestrustee of the plan

|

|

VOTING AND SOLICITATION OF PROXIES

(who votevotes the shares on behalf of the respective plan participants) havehas adequate time to tabulate the voting instructions. Shares held in the 401(k) plan that are not voted or for which the trustees dotrustee does not receive timely voting instructions will be voted by the trusteestrustee in the same proportion as the shares held in the plan that are timely voted.

Voting Other than by Proxy. While we encourage holders of our Class A Common Stock to vote by proxy, holders of our Class A Common Stock (other than shares held in the 401(k) plan) also have the option of voting their shares during the Annual Meeting by following the instructions on the Annual Meeting website once they enter the meeting. Some holders of our Class A Common Stock hold their shares in “street name” through a broker or other nominee and are therefore known as “beneficial holders.” Beneficial holders should follow the voting instructions provided to them by their broker or other nominee in order to vote during the Annual Meeting.

REVOCATION OF PROXIES

A proxy may be revoked before the voting deadline (i) by sending written notice to Proxy Services, P.O. Box 9111, Farmingdale, NY 11735-9543, (ii) by timely submission (including telephonic or Internet submission as described above) of a proxy bearing a later date than the proxy being revoked or (iii) by voting during the Annual Meeting. Revocations made by telephone or through the Internet must be received by 11:59 p.m., Eastern Daylight Time, on MayJune 7, 20233, 2024. Beneficial holders should follow the voting instructions provided to them by their broker or other nominee in order to revoke their proxy or change their vote.

Shares Held in our 401(k) Plan. Voting instructions relating to shares of our Class A Common Stock held in our 401(k) plan may be revoked prior to 11:59 p.m., Eastern Daylight Time, on May 3, 202330, 2024, by timely submission (including telephonic or Internet submission as described above) of revocation or of voting instructions bearing a later date than the voting instructions being revoked to Proxy Services, P.O. Box 9111, Farmingdale, NY 11735-9543.

QUORUM

Under our Amended and Restated Bylaws, the holders of a majority of the aggregate voting power of our Class A Common Stock outstanding on the record date, present in person or represented by proxy at the Annual Meeting, will constitute a quorum. Abstentions and broker non-votes will be treated as present for purposes of determining the presence of a quorum.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

The principal business of the Annual Meeting will be the consideration of the following matters:

| 1. | The election of |

| 2. | The ratification of the appointment of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm (“independent auditor”) for fiscal year |

| 3. |

|

| 4. |

|

| 5. | A stockholder proposal, if properly presented at the meeting, requesting that our Board of Directors take steps to adopt a policy |

| 6. | A stockholder proposal, if properly presented at the meeting, requesting |

The Board recommends a vote FOR matters 1, 2, and 3 THREE YEARS on matterand 4, and AGAINST matters 5 and 6.

The affirmative vote of the holders of a majority of the aggregate voting power of our Class A Common Stock entitled to vote and present in person or represented by proxy at the Annual Meeting is required to elect each of the nominated directors and to determine Items 2, 5each of the remaining voting items, other than Item 4. The affirmative vote of the holders of a majority of our Class A Common Stock outstanding on the record date is required to approve the amendment and 6. Items 3 and 4 are advisory votes only and are not binding. Notwithstanding the advisory naturerestatement of these votes, as discussed under “Item 3” and “Item 4” below, the Board will consider the voting outcomes when making determinations regarding these matters.our Charter (Item 4). An abstention with respect to matters 1, 2, 3, 5 and 6any voting item will have the effect of a vote against such matter, and an abstention with respect to matter 4 will not have an effect on the outcome of that matter.item.

| 6 PARAMOUNT GLOBAL |

|

VOTING AND SOLICITATION OF PROXIES

Under the listing standardsrules of the Nasdaq stock market (“Nasdaq”), a broker or other nominee holding shares of our Class A Common Stock on behalf of a beneficial holder may not be permitted to exercise voting discretion with respect to some matters to be acted upon at stockholders’ meetings. Therefore, if a beneficial holder does not give the broker or nominee specific voting instructions, the holder’s shares may not be voted on those matters and a broker non-vote will occur. Under the Nasdaq listing standards,rules, brokers or nominees may vote on Item 2, but not on Items 1, 3, 4, 5 and 6, if they do not receive instructions from the beneficial holder of the shares held in street name. A broker non-vote is not treated as a vote on, and will therefore have no effect on the voting results for, Items 1, 3, 4, 5 and 6. A broker non-vote on Item 4 will have the effect of a vote against Item 4.

As of March 13, 2023,April 12, 2024, National Amusements, Inc. (“National Amusements”) beneficially owned, directly and indirectly through a wholly-owned subsidiary, approximately 77.4% of our outstanding Class A Common Stock and approximately 9.7%9.5% of our outstanding Class A Common Stock and Class B Common Stock on a combined basis. Shari Redstone, Chairperson, Chief Executive Officer and President of National Amusements, is our non-executive Board Chair. National Amusements has advised us that it intends to vote all of its shares of our Class A Common Stock in accordance with the recommendations of the Board on Items 1, 2, 3, 4, 5 and 6.all of the voting items. Such action by National Amusements will be sufficient to constitute a quorum and to determine the outcomes of Items 1, 2, 3, 4, 5 and 6each of the voting items in accordance with the Board’s recommendations.

HOW TO SUBMIT QUESTIONS

Holders of Class A Common Stock and Class B Common Stock may submit questions in advance of the meeting, from 9:00 a.m., Eastern Daylight Time, on April 24, 2023May 22, 2024 until 5:00 p.m., Eastern Daylight Time, on May 3, 2023,29, 2024, by visiting www.proxyvote.com, entering their 16-digit control number and following the instructions. Holders of Class A Common Stock and Class B Common Stock may also submit questions during the meeting and will find instructions for doing so on the Annual Meeting website once they enter the meeting.

COST OF PROXY SOLICITATION AND INSPECTOR OF ELECTION

We will pay the cost of the solicitation of proxies, including the preparation, printing and mailing of the Notice of Internet Availability and the proxy materials. We will furnish copies of the Notice of Internet Availability and, if requested, the proxy materials to banks, brokers, fiduciaries and custodians that hold shares on behalf of beneficial holders so that they may forward the materials to the beneficial holders.

American Election Services, LLC will serve as the independent inspector of election for the Annual Meeting.

MAILING ADDRESS

Our mailing address is 1515 Broadway, New York, NY 10036.

|

|

Corporate Governance

Our corporate governance practices are established and reviewed by our Board of Directors. The Board, with assistance from its Nominating and Governance Committee, regularly assesses our governance practices in light of legal and regulatory requirements, input from our stakeholders and governance best practices. In several areas, our practices go beyond the requirements of the Nasdaq listing standards.rules. For example, despite being a “controlled company” (i.e., a company of which more than 50% of the voting power is held by an individual or another company), we have a majority of independent directors on our Board and entirely independent Board committees, including an independent Compensation Committee and an independent Nominating and Governance Committee, although not required for controlled companies under the Nasdaq listing standards.rules. Our Audit Committee is also entirely independent.

Our principal governance documents are as follows:

Corporate Governance Guidelines

Board Committee Charters:

Audit Committee Charter

Compensation Committee Charter

Nominating and Governance Committee Charter

Global Business Conduct Statement

Supplemental Code of Ethics for Senior Financial Officers

These documents are available on the “Investors—Corporate Governance & ESG” page of our website at ir.paramount.com, and copies of these documents may be requested by writing to Investor Relations, Paramount Global, 1515 Broadway, New York, New York 10036. We encourage our stockholders to read these documents, as we believe they illustrate our commitment to good governance practices. Certain key provisions of these documents are summarized below.

CORPORATE GOVERNANCE GUIDELINES

Our Corporate Governance Guidelines (the “Guidelines”) set forth our corporate governance principles and practices on a variety of topics, including the responsibilities, composition and functioning of the Board, director qualifications and the roles of the Board Committees. The Guidelines are periodically reviewed and updated as needed. The Guidelines provide, among other things, that:

A majority of the members of the Board must be independent of the Company, as independence is determined under the Nasdaq listing standardsrules, by the SEC and under the additional standards set forth in the Guidelines;

Each of our Committees must be comprised entirely of independent directors;

| • | Separate executive sessions of the non-management directors and independent directors must be held a minimum number of times each year; |

The Board, acting on the recommendation of the Nominating and Governance Committee, will determine whether a director candidate’s service on more than three other public company boards of directors is consistent with service on our Board;

Director compensation will be established in light of the policies set forth in the Guidelines;

Within three years of joining the Board, directors are expected to own shares of our Common Stock having a market value of at least five times the annual cash retainer paid to them, in accordance with the Guidelines;

| • | Director tenure and retirement will be considered on a case-by-case basis depending on factors such as the director’s age, experience, qualifications, performance and history of service on the Board; |

Each of the Board and its Committees will hold an annual self-evaluation to assess its effectiveness; and

| • | The Compensation Committee and the Nominating and Governance Committee will together review, at least annually, management succession planning and report to the non-management directors on these reviews. |

| 8 PARAMOUNT GLOBAL |

|

CORPORATE GOVERNANCE

BOARD COMMITTEE CHARTERS

Each standing Board Committee operates under a written charter that has been adopted by the Board. We have three standing Committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The Committee charters set forth the purpose, objectives and responsibilities of the respective Committee and discuss matters such as Committee membership requirements, number of meetings and the setting of meeting agendas. The charters are required to be assessed annually, in accordance with the Guidelines, and are updated as needed. More information on the Committees, their respective roles and responsibilities and their charters can be found under “Our Board of Directors — Board Committees.”

GLOBAL BUSINESS CONDUCT STATEMENT

Our Global Business Conduct Statement (“BCS”) sets forth our standards for ethical conduct required of all of our directors and employees. The BCS is available on the “Investors—Corporate Governance & ESG” page of our website at ir.paramount.com and on our intranet sites. As part of our compliance and ethics program, we distribute the BCS to our employees and directors and administer an online BCS training program. Directors and full-time employees are required to certify as to their compliance with the BCS and, on an ongoing basis, disclose any potential conflicts of interest. The BCS addresses, among other things, topics such as:

Compliance with laws, rules and regulations, including the Foreign Corrupt Practices Act;

Conflicts of interest, including the disclosure of potential conflicts to the Company;

Confidentiality, insider information and trading, and fair disclosure;

Financial accounting and improper payments;

Our commitment to providing equal employment opportunities and a discrimination- and harassment-free workplace environment;

Fair dealing and relations with competitors, customers and suppliers;

Health, safety and the environment; and

Political contributions and payments.

The BCS provides numerous avenues for employees to report potential violations of the BCS or other matters of concern, whether anonymously or with attribution. These avenues include adomestic and international telephone hotline, ahotlines and an affiliated website, andas well as providing for direct communication withsubmission of reports to our compliance officers and lawyers. The BCS also provides that we will protectprohibit retaliation against anyone who makes a good faith report of a potential violation of the BCS and that retaliation against an employee who makes a good faith report will not be tolerated.BCS.

Waivers of the BCS for our executive officers or directors, will beif any, are disclosed on our website at ir.paramount.com or by Form 8-K filed with the SEC.

SUPPLEMENTAL CODE OF ETHICS FOR SENIOR FINANCIAL OFFICERS

The Supplemental Code of Ethics is applicable to our President and Chief Executive Officer, our Chief Financial Officer and our Chief Accounting Officer. The Supplemental Code of Ethics addresses matters specific to those senior financial positions in the Company, including responsibility for the disclosures made in our filings with the SEC, reporting obligations with respect to certain matters and a general obligation to promote honest and ethical conduct within the Company. The senior financial officers are also required to comply with the BCS.

Amendments to or waivers of the Supplemental Code of Ethics for these officers will be disclosed on our website at ir.paramount.com or by Form 8-K filed with the SEC.

|

|

Our Environmental, Social and Governance (ESG) Strategy

Paramount is committed to responsible and sustainable business practices, which strengthen our ability to innovate and better serve our partners, audiences and stockholders. We continue to expand upon our environmental, social and governance (“ESG”) strategy, with the goal of transparently managing and communicating our most material ESG impacts and initiatives.

We are committed to implementing and tracking progress against goals that will position us as a leader in ESG and sustainability. This commitment informs our work to integrate ESG into the way we do business and better understand our ESG impacts as a company and across our global brands.

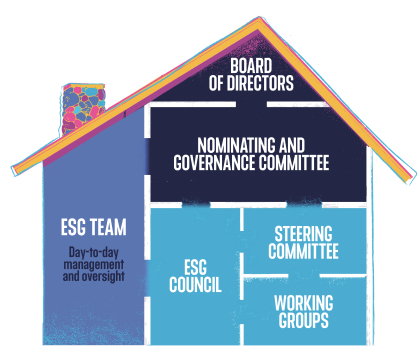

HOW WE MANAGE ESG

Our commitment to ESG starts at the top, with our Board of Directors and senior leadership. The Nominating and Governance Committee of the Board has direct oversight of our handling of ESG matters and regularly considers ESG-related matters at its meetings.

We have a team dedicated to driving our ESG strategy forward and overseeing our annual reporting and responses to ESG inquiries and assessments, which is led by a steering committee that includes our Chief Executive Officer, Chief Financial Officer and General Counsel. We have prioritized transparency and disclosure, particularly of our most material ESG impacts.

Our ESG strategy consists of three pillars: On-Screen Content and Social Impact; Workforce and Culture; and Sustainable Production and Operations. Each of these pillars captures important parts of our business and the way we operate. As we develop and publish ESG goals in each area, we will continue to ensure these goals are relevant to our business, audiences and shareholders. |   |

| 10 PARAMOUNT GLOBAL |

|

OUR ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) STRATEGY

OUR ESG COMMUNICATIONS

InParamount’s ESG Reports, published annually since 2020, we conducted and published the resultsprovide our stakeholders with a comprehensive overview of our firstsustainability strategy and progress. The foundation for our ESG strategy is our 2020 Company-wide ESG materiality assessment, to identifywhich identified the most important ESG-related risks and opportunities across our business globally. The results of this materiality assessment informed our ESG strategy, which we also launched in 2020 as part of our first annual comprehensive ESG Report. Our 2020 ESG Report provided our key stakeholders with more detail about our commitment and approach to managing ESG strategically acrossreports highlight progress toward the Company.

In 2021, we continued to make diversity, equity, inclusion and belonging cornerstones of our culture and business. As part of our efforts to build a culture of transparency and accountability, we reported on gender and ethnic diversity across all levels of our organization. More information about these efforts is available on our website at www.paramount.com/inclusion. We also continued to develop measurable and time-boundCompany’s ESG goals, that align with the future of our business and the unique power of our Company and its brands. The 2021 ESG Report disclosed qualitative and quantitative data across several relevant topic areas, including diversity and inclusion, our culture, and our efforts to elevate the importance of sustainable production across the media and entertainment industry.

In 2022, we published our third annual ESG Report, which outlines the Company’s progress toward its ESG goals. The 2022 ESG Report includes updatedyear-over-year workforce and environmental impact data, an overview of the Company’s ESG governance practices, and additional information regarding our efforts to advance diversity and inclusion in front of and behind the camera through the Company’s Office of Global Inclusion and global Content for Change initiative. To learn more about our diversity initiatives, please visit www.paramount.com/inclusion.

Our latest ESG Report, published in September 2023, provides additional information on how the Company engages with its internal and external stakeholders to better understand and address the ESG challenges and opportunities of greatest interest to these groups.

In 2023, we will continue to pursue our Company-wide ESG goals and2024, we are working to identify appropriate ESG-related targetspiloting and goals for several of ourexpanding ESG initiatives across various brands and business units. To further integrate these targets and goals

|

OUR ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) STRATEGY

across our operations, we are leveragingWe will continue to leverage our ESG governance structure to pilotenhance the management of our most material environmental and expand ESG initiatives across the organization, which will help us advance what matters most to our business. We will continue to report on our material ESG-related risks and opportunities and progress towards our targets and goals, including our diversity and workforce engagement initiatives, our climate change-related disclosures, and our approach to understanding and managing our ESGsocial impacts.

To learn more about Paramount’s ESG efforts and to view our materiality assessment and ESG reports, please visit: www.paramount.com/sustainability.

OUR POLICIES AND PRACTICES CONCERNING POLITICAL ACTIVITY

We believe that civic engagement and participation in the political process are important to our business, our stakeholders and our country. Public policy decisions often have a significant impact on our business, and we believe that being involved in the political process is important to our success. We are committed to participatingparticipate in the political process to promote our interests and business objectives without regard to the personal political beliefs of our employees’employees or our directors’ political beliefs.directors. We therefore, support candidates seeking elected office at all levels of government who support issuescan help advance policies important to Paramount’s business, including those related to intellectual property, copyright, tax and foreign trade issues.trade.

We believe that our governance practices regarding Company political activity are robust and that our current disclosures allow stockholders and other stakeholders to understand these priorities and practices. Our Nominating and Governance Committee periodically reviews our policies and practices regarding political expenditures and contributions.

Our BCS applies to all Paramount employees and directors and contains policies governing political contributions, lobbying and personal political activities. Compliance with the BCS is overseen by our Compliance team and, with respect to the policies relating to political activities, our Government Relations team. Our Audit Committee is responsible for reviewing the BCS at least biennially. As noted below, all political contributions and activities by Paramount must be approved in advance by Paramount’s Government Relations Office.

Our public policy priorities and strategies,advocacy, political contributions and support of trade association membershipsassociations promote our business objectives and alloware described in our ESG Report, which allows our stockholders and other stakeholders to evaluate our positions for consistency with ourCompany goals and stockholder interests.

State & Local Contributions; Ballot Measures:Measures. Where permitted by law, we may contribute directly to state and local candidates, state party committees and other state and local political entities, as well as toand ballot measure committees. All such Company contributions must be approved in advance by our Government Relations Office. TheseThe contributions are disclosed under applicable laws that requirerequiring recipients of political contributions to discloseprovide the source, date and amount of all contributions received and, in the case of statesuch contributions. State and local contributions to candidates and party committees are also publicly available on the websites of the relevant state agencies for contributions made to state candidates and committees.agencies.

Independent Expenditures; 501(c)(4) Organizations; 527 Committees:Committees. While companies are permitted by law to engage in independent expenditures or electioneering communications to advocate for the election or defeat of federal, state or local candidates, we do not engage directly in such activity at this time. We also do not make donations to 501(c)(4) organizations or 527 Committees at this time. To the extent that we make any such contributions, all such Company contributionsthey must be approved in advance by our Government Relations Office.

Political Action Committee:Committee. As permitted by U.S. law, we have created the Paramount Global Political Action Committee (the “Paramount PAC”) to collect employee donations to contribute to federal candidates and other committees regulated by the Federal Election Commission (the “FEC”). Contributions to federal candidates and committees are made only through the Paramount PAC, in accordance with FEC regulations, and all contributions are managed by our Government Relations Office. To provide funding for the Paramount PAC, we periodically solicit voluntary contributions from eligible

2024 PROXY STATEMENT 11 |

OUR ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) STRATEGY

employees. We fully disclose all Paramount PAC activity on reports filed with the FEC, which are publicly available on the FEC’s website at https://www.fec.gov./data/committee/C00167759/. The Paramount PAC does not contribute to state or local candidates and committees.

Political Expenditures by Trade Associations:Associations. We are a member of certain trade associations and coalitions, such as the Motion Picture Association, NCTA – the Internet & Television Association, and the National Association of Broadcasters, that we believe can assist us in achieving our long-term strategic goals. Some of these associations and coalitions engage in lobbying and policy advocacy. Payments to these organizations, such asincluding trade association dues, do not imply our agreement with or endorsement of an organization’stheir activities, positions or expenditures, and weexpenditures. We do not know norand do wenot control the amountportion of our payments that aremay be used by these organizations for political contributions.

| 12 PARAMOUNT GLOBAL |

|

Our Board of Directors

Our Board is currently comprised of 1211 members: Robert M. Bakish, Candace K. Beinecke, Barbara M. Byrne, Linda M. Griego, Robert N. Klieger, Judith A. McHale, Ronald L. Nelson,Dawn Ostroff, Charles E. Phillips, Jr., Shari E. Redstone, Susan Schuman, Nicole Seligman and Frederick O. Terrell.

MEETINGS OF THE BOARD

During 2022,2023, the Board held 1017 meetings, and each of our current directors attended at least 75% of the meetings of the Board and Board Committees on which such director served.

In addition to Board and Committee meetings, directors are expected to attend the Annual Meeting and all of theour directors who stood for election in 2022 attended our 20222023 Annual Meeting of Stockholders.

In accordance with the Guidelines and, with respect to the independent director sessions, the Nasdaq listing standards,rules, the non-management directors meet separately without directors who are Company employees, and the independent directors meet separately without directors who are not independent as determined by the Board – in each case, at least two times each year and at such other times as they deem appropriate. The independent Chair of the Nominating and Governance Committee presides at meetings of the independent directors.

DIRECTOR INDEPENDENCE

Our Guidelines provide that a majority of our directors must be independent of the Company, as “independence” is defined in the Nasdaq listing rules, by the SEC and under the additional standards andset forth in the Guidelines. The Nasdaq listing standardsrules set forth six “bright-line” tests that require a finding that a director is not independent if the director fails any of the tests. A Paramount director will not be independent if any of the following relationships exist:

The director is, or has been within the last three years, an employee of Paramount;

A family member of the director is, or has been within the last three years, an executive officer of Paramount;

| • | The director has received, or a family member of the director has received, during any 12-month period within the last three years, more than $120,000 in compensation from Paramount, other than compensation for Board or Committee service, compensation paid to a family member of the director who is an employee (other than an executive officer) of Paramount, or benefits under a tax-qualified retirement plan, or non-discretionary compensation; |

The director is, or has a family member who is, a current partner of our outside auditor, or was a partner or employee of our outside auditor who worked on Paramount’s audit at any time during any of the past three years;

The director is, or has a family member who is, employed as an executive officer of another entity where at any time during the past three years any of the executive officers of Paramount have served on the compensation committee of such other entity; or

| • | The director is, or has a family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which Paramount made, or from which Paramount received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than payments arising solely from investments in Paramount’s securities or payments under non-discretionary charitable contribution matching programs. |

For this purpose, “family member” means the director’s spouse, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, brothers- and sisters-in-law and anyone (other than domestic employees) who shareshares such person’s home.

In addition, the Nasdaq listing standardsrules provide that a director is not independent unless the Board affirmatively determines that the director has no relationship that would impair his or her independence, which we refer to as a “material relationship.”

The Guidelines set forth categorical standards to assist the Board in determining what constitutes a “material relationship” with the Company. Generally, under these categorical standards, the following relationships are deemed not to be material:

The types of relationships identified by the Nasdaq listing standards’rules’ “bright-line” tests, if they occurred more than five years ago (the Board will review any such relationship if it occurred more than three but fewer than five years ago);

|

OUR BOARD OF DIRECTORS

| • | A relationship whereby the director has received, or a family member of the director has received for service as an executive officer, $120,000 or less in direct compensation from us during any 12-month period within the last three years, absent other circumstances; and |

A relationship where the director is an executive officer or employee, or an immediate family member of the director is an executive officer, of the following:

| (i) | a company that made payments to, or received payments from, us for property or services in an amount that, in each of the last three fiscal years, is less than 2% of such company’s annual consolidated gross revenues; |

| (ii) | a company that is either indebted to us or a creditor of ours in an amount that is less than 2% of such company’s total consolidated assets; and |

| (iii) | a tax-exempt organization that received contributions from us in the prior fiscal year in an amount less than the greater of $1,000,000 or 2% of that organization’s consolidated gross revenues. |

For relationships that exceed the thresholds in (ii) and (iii) described above, the determination of whether the relationship is material or not, and therefore whether the director would be independent or not, is made by the directors who are independent. In addition, the Guidelines state that, generally, the types of relationships not addressed by the Nasdaq listing standardsrules or described in the Guidelines will not, by themselves, cause an otherwise independent director to be considered not independent. However, the Board may determine that a director is not independent for any reason it deems appropriate.

In March 2023,April 2024, the Nominating and Governance Committee reviewed the independence of our 12 current directors and of our director nominee who is not currently a member of our Board, to determine its recommendation regarding which of them meet the independence standards outlined above. The Board, based on its review and the recommendation of the Nominating and Governance Committee, determined that nineeight of our 12 current11 directors – Mses. Beinecke, Byrne, Griego, McHale, Ostroff, Schuman and Seligman and Messrs. Nelson, Phillips and Terrell – are independent. The current directors who were not determined to be independent are Ms. Redstone and Messrs. Bakish and Klieger. The Board also determined, based on its review and the recommendation of the Nominating and Governance Committee, that Ms. Ostroff, our director nominee who is not currently a Board member, is also independent.

During its review, in determining that the directors named above are independent, the Board considered that we have, in the ordinary course of business, during the past three years, sold products and services to, and/or purchased products and services from, companies and other entities, of which certain directors are executive officers, principals or employees, and made contributions to a tax-exempt organization of which a director’s immediate family member is an executive officer. The Board determined that all of these transactions were within the parameters for relationships deemed to be immaterial under the Guidelines.

BOARD LEADERSHIP STRUCTURE

Our Board of Directors is currently comprised of the following:

| • | A non-executive Chair of the Board; |

Our President and Chief Executive Officer; and

10Nine other directors, nineeight of whom are independent.

In addition to having a majority independent Board, the Audit, Compensation and Nominating and Governance Committees are composed entirely of independent directors. In support of the independent oversight of management, the non-management directors and, separately, the independent directors routinely hold executive sessions without management present, and Board members have regular access to management across the Company between meetings.

Our Non-Executive Chair of the Board, Shari E. Redstone, presides at all meetings of the Board. Under the Guidelines, her responsibilities also include, together with the Chief Executive Officer and the independent Chair of the Nominating and Governance Committee, developing and approving agendas for Board meetings. The Board believes that Ms. Redstone’s role appropriately reflects both her breadth of experience in the entertainment industry and her ownership position in and role at National Amusements.

| 14 PARAMOUNT GLOBAL |

|

OUR BOARD OF DIRECTORS

BOARD RISK OVERSIGHT

Board of Directors

Our Board of Directors has overall responsibility for the oversight of our risk management processes. The Board carries out its oversight responsibility directly and through the delegation to its Committees of responsibilities related to the oversight of certain risks.

Committees of the Board

| ||||||||||||||||||||||||||||

Audit Committee

The Audit Committee is responsible for reviewing our processes and policies with respect to risk assessment, risk management and risk acceptance and receives reports from our Chief Audit Executive on the Company’s strategic risk management program. The Committee regularly discusses risks as they relate to its review of our financial statements, the evaluation of the effectiveness of internal control over financial reporting, compliance with legal and regulatory requirements, and the performance of the internal audit function, among other responsibilities set forth in the Committee’s charter. PricewaterhouseCoopers LLP (“PwC”), our independent auditor, attends Committee meetings and participates in these discussions. The Audit Committee receives regular reports:

• from our Chief Financial Officer and the Chief Accounting Officer on the integrity of internal control over financial reporting;

• from our Chief Technology Officer and our Chief Information Security Officer on our information security program and the management of cybersecurity risk;

|

Compensation Committee

The Compensation Committee adopts and periodically assesses the Company’s compensation philosophy, strategy and principles, and monitors risks associated with the design and administration of our performance-based and other compensation programs, to promote an environment that does not encourage unnecessary and excessive risk-taking by our employees. The Committee also reviews risks related to human capital resources, including pay equity, management succession planning (in conjunction with the Nominating and Governance Committee) and the depth of our senior management. ClearBridge Compensation Group LLC (“ClearBridge”), the Committee’s independent compensation consultant, attends Committee meetings and participates in these discussions. |

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for the review of the following risk management processes at the Company: business continuity planning, disaster recovery, crisis management, management succession planning (in conjunction with the Compensation Committee), significant issues impacting our culture and reputation, | ||||||||||||||||||||||||||

|

OUR BOARD OF DIRECTORS

• from our Chief Audit Executive on internal audit activities and our internal audit plan for the upcoming fiscal year, the scope of which is to determine the adequacy and function of our risk management, control and governance processes;

• from our General Counsel on employee investigations and our insurance program; and

• from our Chief Compliance Officer on compliance activities.

| ||||||||||||||||||||||||||

For additional information on the Committees’ functions, see “Board Committees.”

Each of these Committees reports regularly to the Board on these risk-related matters, among other items within its purview.

On a regular basis, the Board engages in discussions (which include both internal and external experts) that assist the Board and management in preparing and implementing strategic initiatives. The Board receives regular reports from management that include matters affecting our risk profile, including operations reports from the Chief Executive Officer and from division heads, all of which include strategic and operational risks; reports from the Chief Financial Officer on financial results and projections, credit and liquidity risks and investor relations matters; and reports from the General Counsel on legal and regulatory risk and material litigation.

Outside of formal meetings, Board members have regular access to executives, including the Chief Executive Officer, the Chief Financial Officer, the Chief Accounting Officer, the General Counsel and the Chief People Officer. The Committee and management reports and real-time management access collectively provide the Board with integrated insight on our management of risks.

INFORMATION SECURITY AND CYBERSECURITY

The Audit Committee has oversight ofoversees our processes and policies with respect to information security and cybersecurity and, as described above, receives regular reports from the Chief Technology Officer and Chief Information Security Officer. In 2022, the Board and management engaged in a simulated exercise designed to prepare for a potential cybersecurity incident. We also maintain a Cyber Liability insurance program. Additional information about our information security program and the management of cybersecurity risk is available in our Annual Report on Form 10-K for the year ended December 31, 2023 and in our ESG Report on our website at www.paramount.com/sustainability.

|

OUR BOARD OF DIRECTORS

BOARD COMMITTEES

The following chart sets forth the current membership of each standing Board Committee. The Board reviews and determines the membership of the Committees at least annually.

Committee | Members | |

Audit Committee | Barbara M. Byrne, Chair Judith A. McHale

Frederick O. Terrell | |

Compensation Committee | Judith A. McHale, Chair Linda M. Griego

| |

Nominating and Governance Committee |

Charles E. Phillips, Jr. | |

| 16 PARAMOUNT GLOBAL |

|

OUR BOARD OF DIRECTORS

During 2022,2023, the Audit Committee held nineeight meetings, the Compensation Committee held eight12 meetings and the Nominating and Governance Committee held six meetings. Information about these Committees, including their respective roles and responsibilities and charters, is set forth below.

Audit Committee

The Audit Committee Charter provides that the Audit Committee will be comprised of at least three members, except that the Committee is deemed to be properly constituted with at least two members in the event of a vacancy until the Board fills the vacancy. The Charter also provides that all of the members on the Committee must be independent directors. The Committee must have at least one “audit committee financial expert” and one member who is “financially sophisticated” (each as described below), and all Committee members must be able to read and understand fundamental financial statements. The Committee holds at least five regular meetings each year, and it meets separately throughout the year with the independent auditor, our Chief Financial Officer, our Chief Accounting Officer, our General Counsel, our Chief Compliance Officer and our Chief Audit Executive.

The Committee has the power to delegate its authority and duties to subcommittees or individual members of the Committee, as well as to retain outside advisors, in its sole discretion. The Committee has the sole authority to retain and terminate any such advisors and to review and approve such advisors’ fees and other retention terms.

The Committee is responsible for the following, among other things:

Reviewing our processes and policies with respect to risk assessment, risk management and risk acceptance;

The appointment, retention, termination, compensation and oversight of our independent auditor, including reviewing with the independent auditor and management the scope of the audit plan and audit fees;

Reviewing our financial statements and related disclosures, including with respect to internal control over financial reporting;

Oversight of our internal audit function;

Oversight of our process and policies with respect to information security and cybersecurity; and

Oversight of our compliance with legal and regulatory requirements.

For additional information on the Committee’s role and its oversight of the independent auditor during 2022,2023, see “Report of the Audit Committee.”

Audit Committee Financial Experts. The Board has determined that each member of the Audit Committee who is also a director nominee, including Ms. Byrne, the Chair of the Audit Committee, Ms. McHale and Mr. Terrell is “financially sophisticated” under Nasdaq listing standardsrules and qualifies as an “audit committee financial expert” as that term is defined in the regulations promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

|

OUR BOARD OF DIRECTORS

Compensation Committee

The Compensation Committee Charter provides that the Compensation Committee will be comprised of at least three members, except that the Committee is deemed to be properly constituted with at least two members in the event of a vacancy until the Board fills the vacancy. The Charter also provides that all of the members on the Committee must be independent directors and also “non-employee directors” pursuant to Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Committee holds at least four regular meetings each year, and it regularly meets separately at these meetings with its independent compensation consultant and our Chief People Officer.

The Committee has the power to delegate its authority and duties to subcommittees or individual members of the Committee, as well as to retain a compensation consultant and other outside advisors, as it deems appropriate and in accordance with applicable laws and regulations. The Committee has the sole authority to retain and terminate any such advisors and to review and approve such advisors’ fees and other retention terms.

The Committee is responsible for the following, among other things:

Adopting and periodically reviewing our compensation philosophy, strategy and principles regarding the design and administration of our compensation programs;

2024 PROXY STATEMENT 17 |

OUR BOARD OF DIRECTORS

Reviewing and approving the total compensation packages and the material terms of any new employment, consulting, supplemental retirement and severance arrangements for our executive officers and other senior executives identified by the Committee at least annually after consultation with members of management (collectively, the “specified employees”);

Overseeing the administration of our incentive compensation plans and equity-based compensation plans;

Reviewing key management succession planning (in conjunction with the Nominating and Governance Committee) as contemplated by the Guidelines;

Overseeing an annual risk assessment of our compensation programs; and

Overseeing periodic risk assessmentsthe administration of our compensation programs.clawback policy for senior executives.

Consideration and Determination of Executive Compensation. The Compensation Committee reviews all components of the specified employees’ compensation, including base salary, annual and long-term incentives and other compensatory arrangements. In approving compensation for the specified employees, the Committee considers the input and recommendations of the Chief Executive Officer, the Chief People Officer and any other executive officers to whom those executives report. As described below, the Compensation Committee also considers the input from its independent compensation consultant in making decisions on compensation matters.

The Committee reviews and approves goals and objectives relevant to the compensation of the President and Chief Executive Officer and, together with the Nominating and Governance Committee, annually evaluates his performance in light of those goals and objectives, after considering the input of the non-management directors. The results of this evaluation are then reported to the non-management directors. The Compensation Committee sets the compensation of our President and Chief Executive Officer, taking this evaluation into account, and reports to the Board on this process.

As authorized by its Charter, the Committee has delegated to the President and Chief Executive Officer limited authority to grant long-term incentive awards under our long-term incentive plan to executives who are not specified employees, in connection with their hiring, promotion or contract renewal and to modify certain terms of outstanding equity grants in some post-termination scenarios, as discussed in the “Compensation Discussion and Analysis” section. Any use of this delegated authority is reported to the Committee at its next regularly-scheduledregularly scheduled meeting.

Our processes and procedures for the consideration of executive compensation and the role of our executive officers in determining or recommending the amount or form of executive compensation are more fully described in the “Compensation Discussion and Analysis” section.

The Committee currently retains independent compensation consulting firm ClearBridge Compensation Group LLC to provide expert compensation advice to the Committee in its review of senior executive and other employee compensation. The Committee has the sole authority to retain and terminate the independent compensation consultant and to review and approve the firm’s fees and other retention terms. The Committee maintains a policy requiring that its independent compensation consultant not provide services to the Company other than (i) its services to the Committee and (ii) its services to the Company with respect to the evaluation of non-employee director compensation. ClearBridge did not provide any other services to the Company in 2022.2023. In furtherance of the Committee’s review of our senior executive compensation, the independent consultant examines the compensation practices at companies with which we compete

|

OUR BOARD OF DIRECTORS

for senior executive talent, including those companies engaged in similar business activities and other publicly-traded U.S. companies, and provides other analysis, as more fully described in the “Compensation Discussion and Analysis” section. In March 2023,April 2024, the Compensation Committee assessed the independence of ClearBridge and determined that the firm’s work for the Committee did not raise any conflicts of interest.

Nominating and Governance Committee

The Nominating and Governance Committee’s Charter provides that the Nominating and Governance Committee will be comprised of at least three members, except that the Committee is deemed to be properly constituted with at least two members in the event of a vacancy until the Board fills the vacancy. The Charter also provides that all of the members on the Committee must be independent directors. The Committee holds at least three regular meetings each year.

The Committee has the power to delegate its authority and duties to subcommittees or individual members of the Committee, as well as to retain outside advisors, in its sole discretion. The Committee has the sole authority to retain and terminate any such advisors and to review and approve such advisors’ fees and other retention terms.

| 18 PARAMOUNT GLOBAL |

|

OUR BOARD OF DIRECTORS

The Committee is responsible for the following, among other things:

Identifying and recommending to the Board nominees for election to the Board and reviewing the composition of the Board as part of this process;

Overseeing all aspects of our corporate governance initiatives, including regular assessments of our principal governance documents;

Establishing criteria and processes for the annual self-evaluations of the Board and its Committees;

Making recommendations to the Board on director compensation matters;

Monitoring developments in the law and practice of corporate governance;

Developing and recommending items for Board meeting agendas;

Reviewing key management succession planning (in conjunction with the Compensation Committee) as contemplated by the Guidelines;

Reviewing transactions between us and related persons;

Overseeing and monitoring significant issues impacting our culture and reputation, as well as our handling of ESG matters;

Periodically reviewing our policies and practices regarding political expenditures and contributions; and

Reviewing the following additional risk management processes and policies at the Company: business continuity planning, disaster recovery and crisis management.

Consideration and Determination of Director Compensation. The Committee annually reviews and recommends for the Board’s consideration the form and amount of compensation for “Outside Directors,” who are directors who are not employees of us or any of our subsidiaries. Only Outside Directors are eligible to receive compensation for serving on the Board, as more fully described in “Director Compensation.”

In accordance with the Guidelines and its Charter, the Committee is guided by three principles in its review of Outside Director compensation: Outside Directors should be fairly compensated for the services they provide to us, taking into account, among other things, the size and complexity of our business and compensation paid to directors of comparable companies; Outside Directors’ interests should be aligned with the interests of stockholders; and Outside Directors’ compensation should be easy for stockholders to understand. Final director compensation determinations are made by the Board.

20232024 Director Nomination Process. In connection with the 20232024 director nomination process, the Nominating and Governance Committee reviewed the current composition of the Board in light of the considerations set forth in its Charter and our Guidelines related to Board composition. In addition, the Committee considered input received from the Board members on Board composition, the directors’ qualifications and any special circumstances that the Committee deemed to be important in its determination. After taking these considerations into account, the Committee determined to recommend to the Board that each of the director nominees set forth in “Item 1 — Election of Directors” be nominated to stand for election at the 20232024 Annual Meeting.

|

OUR BOARD OF DIRECTORS

Board Diversity. The Committee considers diversity as part of its review of the composition of the Board. The Committee considers diversity to be a broadly defined concept that takes into account professional experience, gender and ethnicity, among other characteristics. Multiple industries and areas of expertise are represented on the Board, including entertainment and media, banking, legal, technology, information security and management consulting. Additionally, distinguished contributors to governmental and not-for-profit organizations also serve on the Board. Multiple professions are represented among the directors, including current and past experience as principal executive officers, principal financial officers, attorneys, high-ranking government officials, entrepreneurs and television and film executives. The Committee assesses the effectiveness of its consideration of diversity as part of its annual nomination process when it reviews the composition of the Board as a whole.

2024 PROXY STATEMENT 19 |

OUR BOARD OF DIRECTORS

The following table sets forth certain diversity statistics relating to our current Board members, as required by Nasdaq listing standards:rules:

Board Diversity Matrix (As of March 17, 2023) | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Board Diversity Matrix | ||||||||||||||||||||||||||||||

Total Number of Directors | 12 | 11 | ||||||||||||||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||||||||||||

Part I: Gender Identity | Part I: Gender Identity |

| Part I: Gender Identity |

| ||||||||||||||||||||||||||

Directors | 7 | 5 | 0 | 0 | 7 | 4 | 0 | 0 | ||||||||||||||||||||||

Part II: Demographic Background | Part II: Demographic Background |

| Part II: Demographic Background |

| ||||||||||||||||||||||||||

African American or Black | 0 | 2 | 0 | 0 | 0 | 2 | 0 | 0 | ||||||||||||||||||||||

Alaskan Native or Native American | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||

Asian | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||

Hispanic or Latinx | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | ||||||||||||||||||||||

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||

White | 6 | 3 | 0 | 0 | 6 | 2 | 0 | 0 | ||||||||||||||||||||||

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||

LGBTQ+ | 1 | 1 | 0 | 0 | 1 | 1 | 0 | 0 | ||||||||||||||||||||||

Did Not Disclose Demographic Background | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||

Stockholder Recommendations for Director. The Committee will consider candidates for director recommended by our stockholders. All recommendations by stockholders for potential director candidates must include written materials with respect to the potential candidate and be sent to Christa A. D’Alimonte, Executive Vice President, General Counsel and Secretary, Paramount Global, 1515 Broadway, New York, NY 10036. Our Guidelines and Nominating and Governance Committee Charter set forth certain criteria for director qualifications and Board composition that stockholders should consider when making a recommendation. These criteria include an expectation that directors have substantial accomplishments in their professional backgrounds, are able to make independent, analytical inquiries, and exhibit practical wisdom and mature judgment. Our directors should also possess the highest personal and professional ethics, integrity and values and be committed to promoting the long-term interests of our stockholders. Director candidates recommended by stockholders who meet the director qualifications, which are described more fully in our Guidelines and Nominating and Governance Committee Charter, will be considered by the Chair of the Committee, who will present the information on the candidate to the entire Committee. Director candidates recommended by stockholders will be considered by the Committee in the same manner as any other candidate.

STOCKHOLDER OUTREACH

Our management, including through its investor relations team, conducts stockholder outreach throughout the year to inform our management and Board about the issues that matter most to stockholders. The stockholder outreach efforts include in-person and virtual meetings between management and individual and group investors and management presentations at investor and industry conferences, including question-and-answer sessions, on a regular basis. Our investor relations group also responds to retail investor email and telephone inquiries, providing access to our representatives and a forum for providing feedback. The investor relations team, certain NEOs and/or other members of management and operating executives meet with our largest investors throughout the year, and management reports to the Board regularly on stockholder engagement efforts.

|

OUR BOARD OF DIRECTORS

COMMUNICATIONS WITH DIRECTORS

Stockholders and other parties interested in contacting our non-management directors may send an email to nonmanagementdirectors@paramount.com or write to Paramount Global, 1515 Broadway, New York, NY 10036, Attention: Non-Management Directors – 52nd Floor. The non-management directors’ contact information is also available on the “Investors—Shareholder Services, Alerts, & FAQs” page of our website at ir.paramount.com. Communications sent to the non-management directors are screened by the Corporate Secretary’s office and reported to the non-management directors as appropriate. The non-management directors have approved the process for handling communications received in this manner.

| 20 PARAMOUNT GLOBAL |

|

OUR BOARD OF DIRECTORS

Stockholders should also use the email and mailing address for the non-management directors to send communications to the Board. The process for handling stockholder communications to the Board received in this manner has been approved by the independent directors of the Board. Correspondence relating to accounting or auditing matters will be handled in accordance with procedures established by the Audit Committee for such matters.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Compensation Committee during fiscal year 20222023 was, or has ever been, an officer or employee of the Company, and, during fiscal year 2022,2023, no executive officer of the Company served on the board and/or compensation committee of any company that employed as an executive officer any member of our Board and/or Compensation Committee.

|

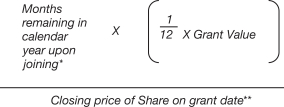

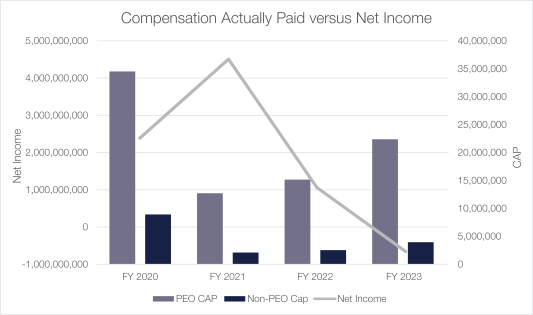

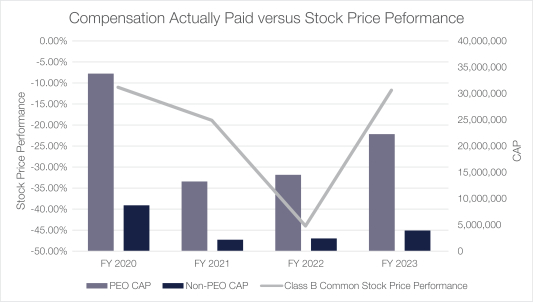

Security Ownership of Certain Beneficial Owners and Management